Luckily for us, there are a number of lenders and monetary products that can be tailored to fulfill Everybody’s special borrowing needs.

Because a lender appears to be like credible doesn’t signify it is. You are able to avoid traps like high interest rates and concealed costs by looking into lenders prior to deciding to indicator any agreements.

Remember that a created agreement is don't just a smart idea to safeguard your partnership, but the IRS has sure rules about loans, even involving close relatives, to ensure the mortgage is not dealt with as a gift.

Banks and credit score unions ordinarily approve own lines of credit for people who already have a examining account. On-line lenders might offer you them, however it is considerably less popular.

Public organizations, for example the government or nonprofits, typically have packages and financial loans to aid out through economical emergencies.

Just as there are actually other ways to borrow money, lenders may offer various repayment terms, or charge different charges for the same kind of financial loan. For example, if you are interested in a personal mortgage, don’t believe that each bank will give the same own financial loan arrangement.

Enhance has a set of capabilities which make it an exceedingly desirable lender: competitive interest premiums, reductions for immediate pay and autopay, the moment exact-day funding, nearly 7-year repayment conditions, and nationwide availability.

Other factors may perhaps include things like: your credit rating profile and what goods we expect you want. It is this compensation that allows Credit history Karma to present you with expert services like free of charge use of your credit scores and cost-free monitoring within your credit history and fiscal accounts.

The leading catch is you need to qualify for a loan with SoFi, that may be tough to do if you do not have good credit. You also won't be capable of utilize with a cosigner, because SoFi does not settle for cosigners; nor does get more info it supply secured private financial loans.

It provides mortgage amounts around $50,000, repayment conditions as many as 7 a long time, and discount rates for immediate fork out and autopay. Money can be obtained when the subsequent enterprise day right after loan approval.

A personal line of credit rating isn’t a fantastic extended-time period borrowing approach as you can only continue on borrowing through the draw period, which typically lasts two decades. Just after, your line of credit rating will enter a repayment time period just like a personal financial loan.

When you've got distinct questions about the accessibility of this site, or need guidance with utilizing this site, contact us.

An unsecured personal financial loan is money you are able to borrow from the economic establishment like a lender, credit score union, or on-line lender that does not require collateral (like your private home or automobile).

Some lenders even supply an autopay discounted for those who authorize your every month personal loan payments to generally be directly withdrawn from your checking account.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Andrew Keegan Then & Now!

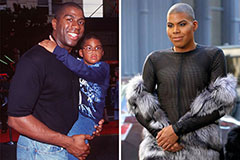

Andrew Keegan Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!